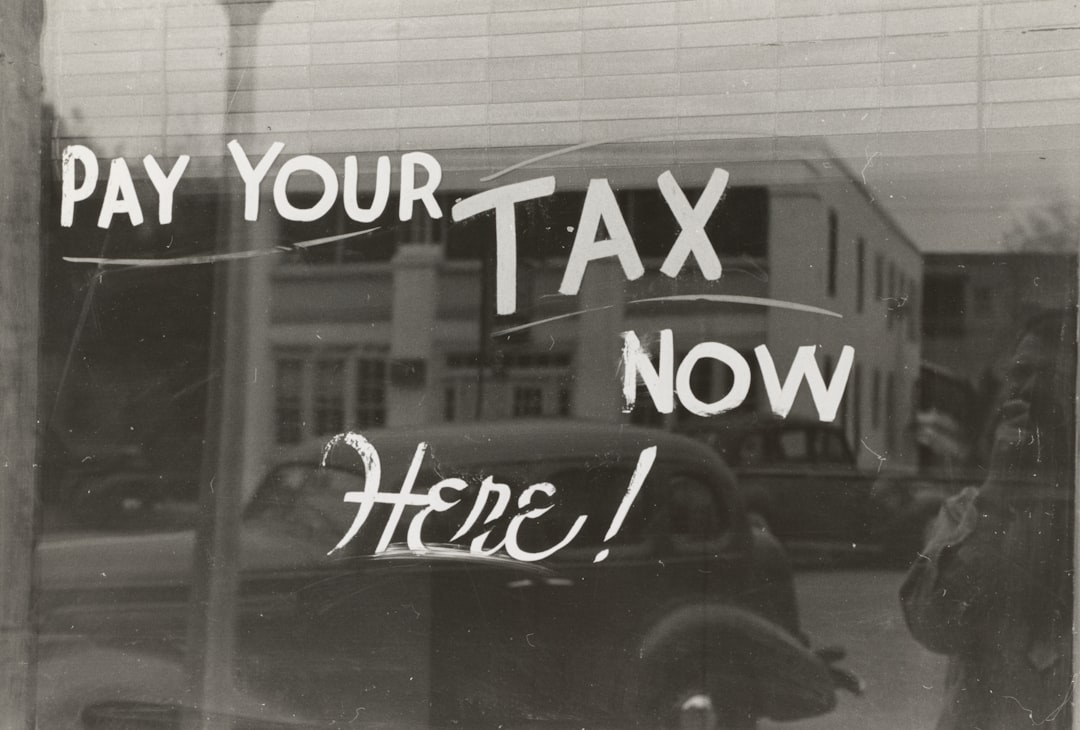

When the Levy breaks

Are you ready to file and pay the Economic Crime (Anti-Money Laundering) Levy for the year ended 31 March 2023?

Not one client I spoke to was aware of this levy (“ECL”). It covers a surprisingly wide range of companies. Even if not directly affected, almost everyone uses the services of a company that is affected, and you can bet your bottom dollar that they will increase their fees to you to recoup the ECL, which will probably add another 0.1% to professional fee inflation.

Will it affect start-ups? Well, read on…

I’m sorry? What is the ECL?

The full government paper sets out that entities regulated for anti-money laundering (AML) purposes under the Money Laundering, Terrorist Financing and Transfer of Funds Regulation 2017 that are medium, large or very large in size based on their UK revenue. The sectors that we expect will be impacted are:

credit institutions

financial institutions

auditors, insolvency practitioners, external accountants and tax advisers

independent legal professionals

trust or company service providers

estate agents and letting agents

high value dealers, casinos, auction platforms and art market participants

crypto-asset exchange providers and custodian wallet providers

An entity is classified as:

small (under £10.2m revenue) - exempt

medium if its UK revenue for the relevant accounting period is more than £10.2 million but not more than £36 million - Pay £10,000

large if its UK revenue for the relevant accounting period is more than £36 million but not more than £1 billion - Pay £36,000

very large if its UK revenue for the relevant accounting period is more than £1 billion - Pay £250,000

The levy will first be paid by in-scope entities at the end of each financial year, meaning first payments will be due in the financial year 1 April 2023 to 31 March 2024. The FCA is the body collecting most of the Levy for the Government, the Gambling Commission and HMRC will do the rest.

Apparently the Government proposes to spend the ECL when collected wisely - £100 million per year from the AML regulated sector should go to pay for government initiatives outlined in the ECP to help tackle money laundering. We can look forward to seeing what that actually means.

This is small beer. Can I ignore it?

Yes, this is a small sum, and it barely affects most of the clients I deal with, but it marks a determined hardening of anti-money laundering policy and points to continuing crack downs on sectors that are felt to be higher risk. History says that governments almost always expand levies and taxes, and almost never remove them.

Any start-up thinking of tackling these sectors needs to think very hard about how they navigate that future world.