Is there an Angel for your business?

Business Angels across Europe have grown in reach, power, and skill rapidly. Finding one remains a complex problem for most business founders, but there are routes that any founder can follow.

Maybe…

Maybe there is an Angel for most qualifying and investible companies. Maybe. The statistics appear good. The gritty is bit is defining “qualifying and investible”.

When you have exhausted the pool of your own sweat equity, and drained the wallets of friends, families, and fools, where do you turn next to get the capital to power your business?

The traditional UK path has been

Own money

Small bank loan, Start-up loan, maybe a small start-up grant

Angel

Venture

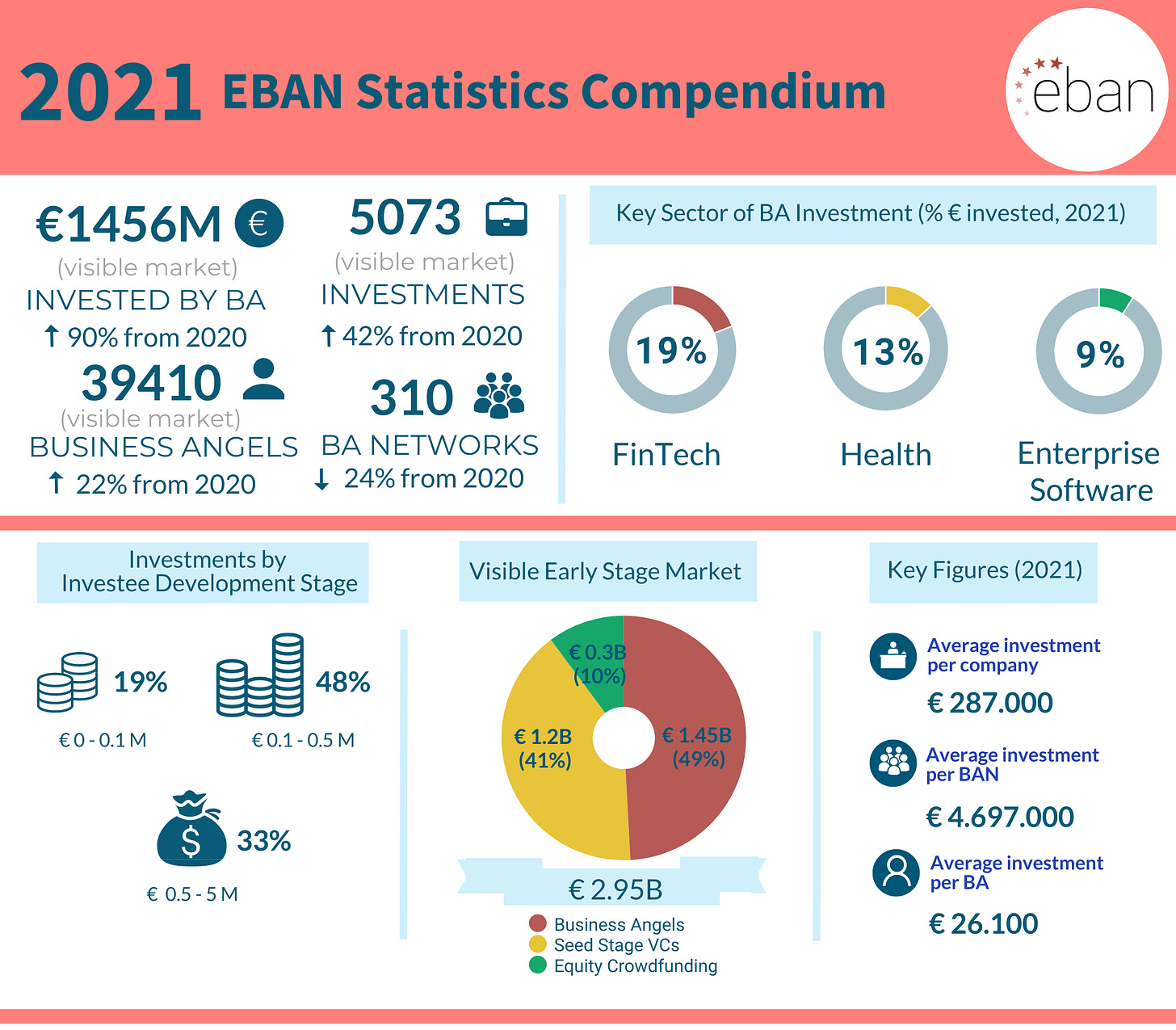

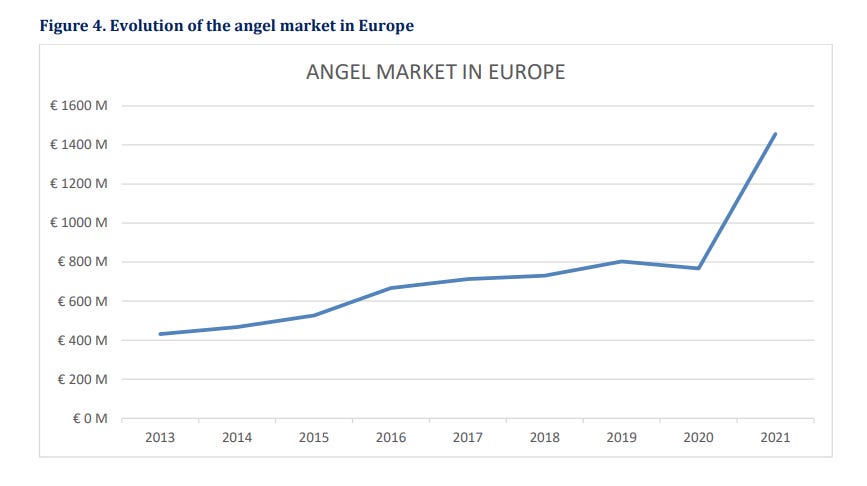

Private Equity

The simple path now has lots of branches - incubators, venture debt, growth loans, corporate VC, etc - but the path is still there, and Angels are a key step along it for most businesses. And they are becoming stronger, more assertive and easier to find right across Europe now. The amount of money available has risen sharply.

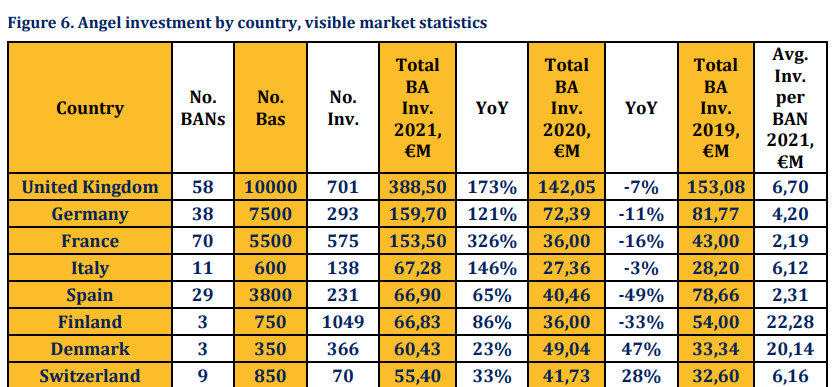

The UK has a really strong network of Business Angel Networks, and that is shown in the investment stats.

Their average investment in a company has risen from about £150k in 2017 to £250k now, and that rise appears to be accelerating. Most of this has come from a few very large “Super Angels”, but some is caused by better group syndication of deals and better networks. Some is also from better “pre-qualification” of companies as they spin out of Universities or Incubators or other Corporate Partners at a slightly later stage of development.

In the UK, changes to SEIS and EIS will continue to make the UK very attractive to business angels for years to come.

The easy availability of lists of Angel Networks, the rise in Growth Hubs, and the excellent work of startup ecosystems in the UK (Startups Magazine, Europas, London Tech Week, etc etc) have made finding Angels and making introductions easier… and resulted in more rejections.

Yes, more rejections.

Why do companies get rejected by Angels?

Most businesses are just not ready to receive investment. They lack one or more critical factors:

defensible innovation

qualified team

proof of market

proof of execution

viable business model

proof the idea can scale

hygiene and administration

An emotional or intellectual attraction to an Angel investor

It isn’t just a beautifully illustrated pitch deck you need; it is the hard business reality and evidence base underneath it, and a solid financial projection based on those that will win hearts and wallets.

Many founders get point 7 wrong, as a previous post has pointed out. You won’t get far asking for equity investment if you have unfiled accounts, or unpaid taxes, or “informal arrangements” rather than cast iron contracts with key staff.

That is why there were just 5,000 odd investments in the “visible” Angel market in 2021 (and, on past experience, about double that in the “private” Angel market) out of some 600,000 new companies registered in the EU in that period. Under 1% of new companies might raise finance, but there are about 24 million businesses across Europe, so the real rate of Angel finance is way less.

Lots of things can go wrong, but do not need to once you know the ropes. That’s why we really like working with founders, and only work with founders. We have done this ourselves for our own companies, as well as acted as advisors to dozens of others.

What was point 8 again?

Emotional and intellectual attraction to an Angel. They are people, not economic machines, and if you want them to invest they need to want to, despite knowing they will probably lose money in 17 out of 20 investments and on average over a decade make a rate of return on their whole portfolio not that much better than a well run pension or property deal.

You need to find the Angel that loves what you do, understands it, and likes you enough to come along on a 7 to 10 year journey.

A Free Gift, Really?

If you are ready to make the leap to finding your first Angel investor, or are talking to one about your business, then here is our free gift to you: a list of 58 of the best the UK Business Angel Networks. (My personal favourites are in bold). Those networks cover about 10,000 individuals.

Our free advice is: give us a call and check you are ready for investment before approaching anyone.

It may be hot times for Angel Investment, but the competition is fierce and you need to be prepared.

24Haymarket Private Capital https://24haymarket.com/

Angel Academe https://www.angelacademe.com/

Angel Groups https://www.angelgroups.co.uk/

AngelClubRCA https://www.rca.ac.uk/business/innovationrca/our-start-companies-angelclubrca-and-investment/

Angels Invest Wales https://developmentbank.wales/other-services/angels-invest-wales

Anglia Capital Group https://angliacapitalgroup.co.uk/

Apollo Informal Investment https://www.apollo-informal-investment.com/home

Archangels https://archangelsonline.com/

Bristol Private Equity Club https://www.bristolprivateequityclub.com/

Cambridge Angels https://www.cambridgeangels.net

Cambridge Capital Group https://www.cambridgecapitalgroup.co.uk

Central England Business Angels https://www.linkedin.co m/company/central-england-business-angels/people/

Chicago Booth Angels https://chicagoboothangels.com/

Community Growth Ventures https://www.linkedin.com/company/communitygrowthventures/

Cornerstone Angel Network https://cornerstonepartners.co.uk/

Dorset Business Angels https://dorsetbusinessangels.co.uk/

Earth Angel Investors https://www.earthangelinvest.co/

East Midlands Business Angels Ltd https://http://www.em-ba.co.uk/

Enterprise 100 https://enterprise100.co.uk/

Equity Gap https://www.equitygap.co.uk/

EVE Investors https://www.eveangelinvestors.com/

Founder Friendly Funding https://www.founderfriendlyfunding.com/

FSE Investor Network https://www.thefsegroup.com/

Gabriel Investments Ltd http://www.gabriel- is.com/

GC Angels https://gcangels.uk/

Grampian Biopartners http://www.grampianbiopartners.com/

Green Angel Syndicate https://greenangelsyndic ate.com/

Greenwood Way Capital https://gwcinvestor.com/

Harvard Business Angels London http://www.hbsa.org.uk

Henley Business Angels https://henleybusinessangels.com/

HERmesa https://hermesa.co.uk/

Highland Venture Capital Ltd http://www.highvc.co.uk/

Investing Women https://www.investingwomen.co.uk/

Kelvin Kapital Ltd https://www.kelvincapital.com/

LCR Angel Network https://www.linkedin.co m/company/lcr-angel-network/

LINC Scotland https://lincscot.co.uk/

London & Scottish Investment Partners http://www.lsip.co.uk/

MAINstream Angel Investor South West Network https://michelmores.com/mainstream

Minerva Business Angel Network https://www.minerva.uk.net

Mint Ventures https://www.mintventures.co.uk/

Newable Ventures https://newable.co.uk/ventures/

NorthInvest https://northinvest.co.uk/

Origin Capital http://www.origingroup.co.uk/

Oxbridge Angels https://oxbridgeangels.com/

Oxford Early Investments https://www.oxfordinnovationfinance.co.uk/

Pringle Capital https://www.pringlecapital.com/

S100 Club https://www.surrey100club.co.uk/

Saturn Investors https://www.saturninvestors.com/

Science Angel Syndicate https://www.scienceangelsyndicate.com/

SFC Capital https://sfccapital.com/

South East Angels https://www.southeastangels.co.uk/

Southern Angel Investors Club http://southernangelinvestorsclub.org.uk/

Stanford Angels of the United Kingdom https://www.stanfordangels.uk/

The FSE Group (Angel Network) https://www.thefsegroup.com/investors

Tri Capital - Informal Private Syndicate https://tricapital.co.uk/

UK Business Angels Association (UKBAA) https://ukbaa.org.uk/

Women Angels of the North https://www.fundhernorth.com/waotn

Yorkshire Association of Business Angels (YABA) https://www.yaba.org.uk